To rent or to sell, that is the question

September 10th, 2023

As a real estate developer, one of the big decisions you need to make is whether you will rent or sell the buildings you've built.

Income from rentals flows in steadily over years, while income from sales hits all at once. This essential difference is simple but has many implications for your risk profile, upside potential, capital requirements, and business model.

The following post is a writeup of my notes as I study real estate development business models. My main goal was to strengthen my own grasp of the tradeoffs, and I figured others might find it interesting too.

Advantages of rentals

Rentals are more resilient to market cycles

If a for-rent project is completed in a downturn, the rents it can command may be lower than expected, but the rents can increase later when the market improves down the road, smoothing out the overall return. For-sale properties don't have that same luxury. In a downturn, they may end up selling all of their units at once at lower prices, just to see the market take a turn for the better shortly after they've finished selling their last unit.

Rents may not even go down in the first place – in downturns, people may be more likely to rent than buy, which can actually lead to higher demand for rental units. People are less likely to make a huge purchase like a home when they feel less optimistic about their wallet.

In the cases when rent prices do fluctuate, existing leases provide a buffer against immediate drops. Imagine you own a building with 120 units each. They're on annual leases, and in any given month, about 10 of them are up for lease renewal. If the market goes south, those 10 units may rent at a lower rate, but at least you have the existing leases from the other 110 units that reduce the impact.

Rentals aren't exposed to construction defect lawsuits, unlike condos

In the US, condo developers face a significant risk of being sued by HOAs or individual unit owners for years after a project is complete. (In California for example, the statute of limitations for construction defect claims is 10 years.) This open-ended litigation risk means that developers don't know when they might get pulled into a costly legal battle.

By contrast, developers that build-to-rent don't face this risk, because they remain the owner. This makes the rental business model much more predictable compared to condo sales.

The high risk of post-construction defect lawsuits for condos has remained a major factor depressing that sector of the development industry in the US. Other countries without such extensive legal recourse periods see much stronger condo development as a result.

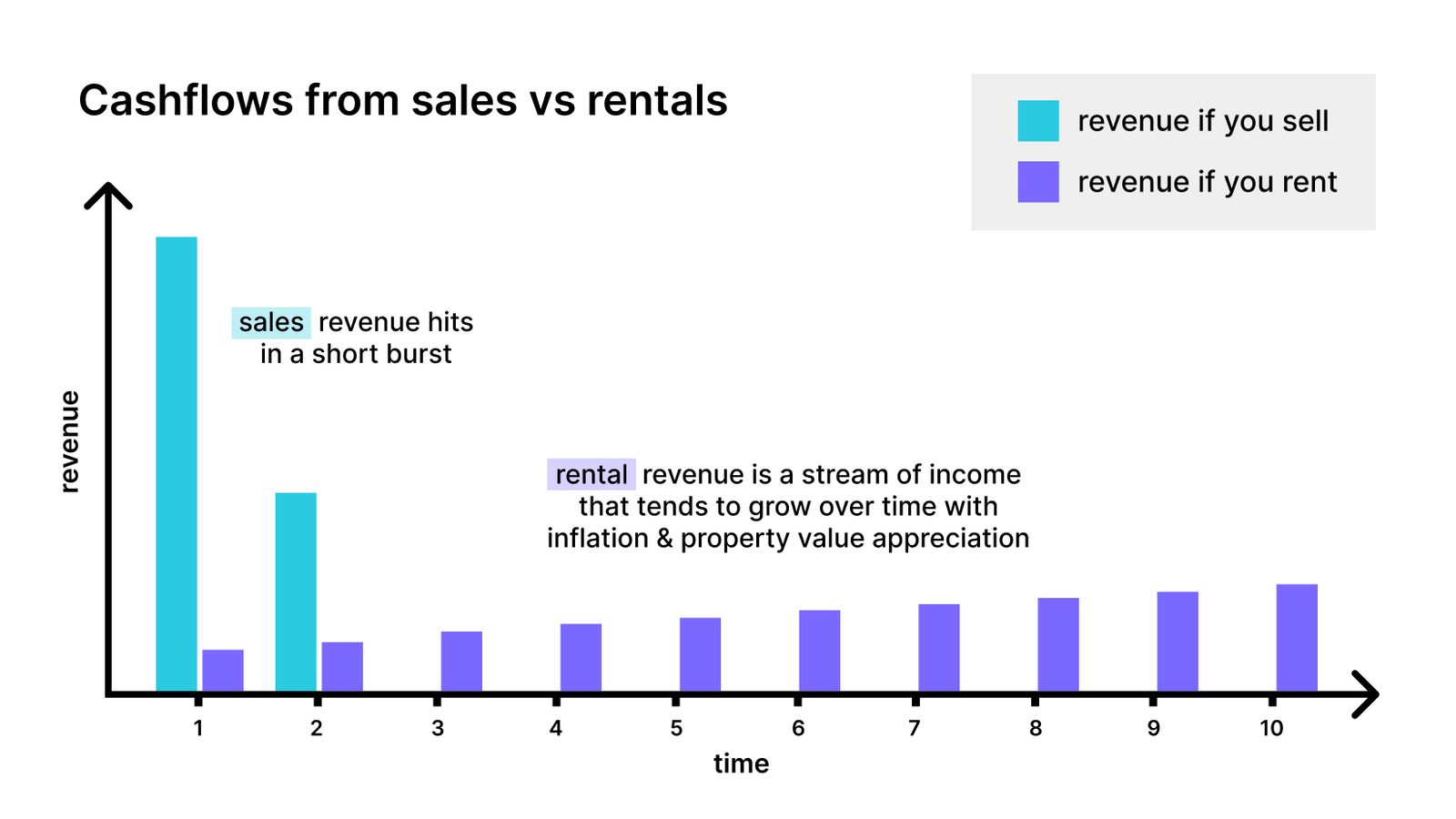

Rentals provide an income stream

Rental units generate a steady monthly revenue for as long as you own the property, providing a predictable cashflow that can be more sustainable and reliable over the long term. By contrast, sales result in a large lump sum upfront, i.e. one-time income that's exhausted once all units are sold. This can be a pro or a con, depending on your goals and financial capacity.

Rentals align the developer's interests with the long-term

Developers who build-to-rent have more of a vested interest in the long-term health of their projects compared to developers who build-to-sell. It shifts the focus from quick short-term gains ("what flashy features will sell this thing as quickly as possible?") to long-term asset management ("how should I invest upfront to ensure that my tenants are happy long-term and to reduce future maintenance?"). This long-term skin in the game promotes better building quality and maintenance practices.

For example, rooftop pools are a big selling point for many big apartment buildings. However, rooftop pools are a maintenance nightmare and can create major structural issues down the road. As a result, developers who build-to-rent tend to put the pool on a lower level of the building, because even though it makes the building slightly less exciting for prospective residents, it saves the owner a big maintenance bill down the line. By contrast, developers who build-to-sell will often bite the bullet and point the pool on the roof, because by the time the structural damage has taken its toll, the HOA and condo owners will be the ones responsible for it.

Rentals allow developers to benefit from property value appreciation

Long-term ownership allows developers to benefit from property value appreciation over time. This can be an especially valuable in situations where the developer has succeeded at "placemaking", i.e. taking an area and turning it into a salient destination. Placemaking can increase property values in the entire neighborhood, and if the developer is responsible for creating that value, they would like to hold onto the property rather than sell it right upon completion, because it takes time for property values to adjust to reflect the new value.

Disneyland is a classic example. Disney transformed agricultural land in Southern California into one of the most desirable destinations in the world, and in doing so it dramatically raised the value of the land it owns beyond what another buyer would have done. By holding the property long-term rather than selling it after the initial development is done, Disney saw a major increase in the value of this asset.

In fact not only do you want to continue to own your own land in a situation like this, but you also want to own the land around it. Disneyland raised the value of not only the land that the corporation itself owned but also all of the land around it. Famously, one of Walt Disney's greatest regrets was not buying more of the land surrounding Disneyland, because this increase in land value was essentially a huge free gift from the Disney company to the farmers who happened to own the neighboring land.

Long-term holds have much more favorable tax treatment

When properties are built with the intention of immediate sale, they are treated as inventory by the IRS, rather than long-term investments. Any profits generated from inventory sales are subject to short-term capital gains, which can be significantly higher than long-term capital gains. Short-term gains are taxed as normal income at the developer's applicable income tax bracket, which can exceed 30% for high profit margins.

In contrast, profits from properties held over a year before sale qualify for preferential long-term capital gains rates of 15-20% depending on the individual's taxable income level. Holding properties long-term as investment real estate also allows depreciation deductions to be claimed annually to offset rental income and further reduce taxes owed over the investment horizon.

Additionally, build-to-rent or build-to-hold strategies utilizing long-term financing like loans or syndications benefit from capital gains tax deferral until the asset is liquidated. As long as the loan balance exceeds the property's depreciated tax basis, no capital gains taxes are due, even if the property appreciates significantly in value.

As a result, developers seeking to maximize after-tax returns generally favor business models that are not dependent on immediate sale profit realization.

Advantages of sales

If you can time the market, you can make a killing

Although you can certainly get on the wrong side of a market cycle, you can also get lucky and have your shiny new units hit the market right at the peak of the cycle. When this happens, developers make outsized returns, because they make all of their money in one lump sum, and at a time when the market is willing to pay the most.

You don't need to raise as much equity for the project

Instead of raising as much money from investors, developers can do pre-sales to count towards their equity portion as required by construction lenders. These pre-sales are often 5-10% of the purchase price. This can bring in substantial capital to serve as equity, and it also shows lenders that there is real demand for what the developer is building, which helps them get more comfortable with lending to the project.

States have varying regulations regarding how developers can handle pre-sale deposits from condo buyers. For example, Florida has some of the strictest pre-sale regulations. Developers in Florida must meet certain escrow, reserve funding, and construction completion milestones before they can sell a significant portion of units. By contrast, Texas developers have more flexibility to sell units earlier in the development process before construction milestones are met.

Pre-sales can be a trial balloon before you go all-in

Another advantage of build-to-sell over build-to-rent is that developers can test market demand through pre-sales before committing to construction. With build-to-rent, developers must secure financing upfront to fund the entire project. But with build-to-sell, pre-sales can gauge buyer interest and absorption rates. Developers can decide not to move forward with construction if pre-sales come in below projections. In contrast, with build-to-rent projects, you’re all-in and hoping people rent it once it’s built.

Cash now, instead of cash later

When developers sell homes upon completion of a project, they are able to fully realize the value of that project in one lump sum payment. This sizable infusion of cash can then be used to pay off any construction loans or lines of credit that financed the project. It also frees up capital that can be reinvested immediately into the next development venture. Not having to wait monthly or annually for rental income to be realized can significantly accelerate a developer's cash flow and funding availability for future projects. The ability to swiftly recoup costs and move on to new opportunities is appealing to developers looking to rapidly grow and scale their business through continual development.

This is especially true when interest rates are high, because the opportunity cost of delayed payments increases as interest rates increase. Cash now is worth more than cash in the future, since that money can begin earning interest right away. Loans are also more expensive as interest rates rise, so getting cash from sales now to pay down high-interest debt more quickly is more important than when interest rates are low.

Your development company can grow faster

The lump sum that comes back to you from a sale can be reinvested into new projects, fueling growth and expansion. Instead of waiting years or decades to make up the total amount to then reinvest into new projects, they can scale at a more rapid pace by recycling profits from previous projects into new opportunities sooner.

It's not all-or-nothing

Sell some, rent some

Some developers balance the pros and cons of both business models by mixing the two product types into one project. They'll sometimes sell some units upfront to pay off lenders and investors, and then maintain the rest of the property as rentals to benefit from the stable, long-term income they generate. For example, in Seaside, FL, the developer took this mixed approach. They sold individual lots for homes but deliberately kept the retail spaces and some apartment units as long-term holdings to generate a consistent rental income stream.

However this approach has been used less and less over time for condo buildings. By only holding onto some, the developer is now inserting themselves into a fractured ownership position with the association, which is a management nightmare. Lenders also don’t finance these as favorably because of the fractured ownership structure. (These issues don't apply in the Seaside case, because Seaside's developer was building an entire neighborhood split among different properties, rather than units within a single building.)

Rent now, sell later

Some developers employ a hold strategy where they initially rent out units for some time before selling (typically 5-10 years) to capture appreciation. This allows values to rise as the property establishes itself and units are fully rented (i.e. the property has "stabilized"). After several years of cash flow from rents, the property is then sold at a profit reflecting the increased value.

Cash-out refinance

Another method that developers like to use is the cash-out refinance, because it gives an immediate cash infusion without having to sell the property. A cash-out refinance is when a property owner refinances their existing mortgage with a larger loan. The difference between the original loan amount and the new, larger refinance loan is given to the borrower in cash. This can be a way for a real estate developer to access capital without having to sell a property.

Let's say a developer owns an apartment building currently financed with a $500,000 mortgage. The building is now worth $800,000. Through a cash-out refinance, the developer could take out a new $800,000 loan to pay off the original $500,000 balance and have $300,000 in cash from the refinance. They can reinvest this money back into the property, use it to invest in future projects, or simply take it out as distributions to investors.

The refinance may also come with a lower interest rate, if the building has become more stable and established over time. For example, a brand new building that hasn't leased any units yet will get a higher interest rate than a building that's full of tenants. So even if the value of the building hasn't gone way up, a refinance can still be beneficial for lowering the owner's monthly payments.

Cash-out refinancing may sound like a magical solution where you can eat your cake and have it too, but it has its limits and isn't always an option. For instance, it likely isn't an option if the property's value has declined below the existing loan amount. Lenders want to make sure the new, larger loan is secured by equity in the property. So if a property is worth less than what's currently owed, the lender has no equity to use for a cash-out refinance. Similarly, a refinance may not pencil out if interest rates have shot up, because monthly payments might be more than before even if the property is more stabilized than before.

A shorthand for thinking about these pros and cons: rentals are generally lower variance, while sales are generally higher variance. They fall into different parts of the risk-reward spectrum.

Depending on your goals, financial capacity, and risk tolerance, rentals and sales each serve different roles in shaping an overall strategy for a development company and its investors.

Thanks to Brad Hargreaves and Omar Morales for their feedback on this post.